RV insurance for salvage titles can be confusing. Each state has its own rules.

Understanding these rules is crucial for RV owners. Buying an RV with a salvage title can be a smart choice. It often means getting a vehicle at a lower price. But insuring it can be tricky. Insurance companies have strict guidelines.

They need to know the RV is safe and roadworthy. This blog covers everything you need to know. We will explore the requirements in different states. You’ll learn how to get insurance for your salvage-titled RV. This knowledge will help you make informed decisions. Stay tuned to find out more about RV insurance for salvage titles in all states.

Introduction To Rv Insurance Salvage Title

Understanding RV insurance can be challenging, especially when dealing with salvage titles. A salvage title impacts many aspects of RV insurance. Knowing the details can help you make better decisions.

What Is A Salvage Title?

A salvage title indicates an RV has been damaged. The damage is significant enough for the insurance company to declare it a total loss. This can happen due to accidents, floods, or other major incidents. The RV is then repaired and inspected before being given a salvage title.

Importance Of Salvage Titles In Rv Insurance

Salvage titles affect RV insurance in several ways. First, they can lower the RV’s value. This influences the insurance premiums you pay. Second, they impact the coverage options available. Some insurance companies may refuse to cover a salvaged RV. Others may offer limited coverage.

Understanding these factors helps in making informed choices. This ensures you get the best possible insurance for your RV. It also helps in understanding what to expect if your RV ever gets a salvage title.

Credit: www.noyeshallallen.com

State-specific Regulations

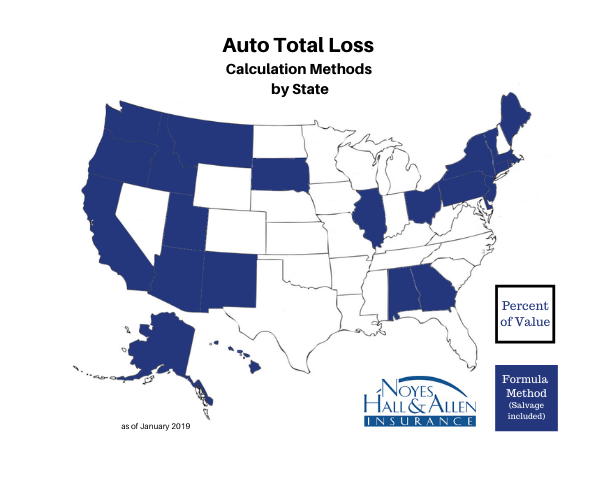

State-specific regulations play a crucial role in RV insurance salvage titles. Understanding these regulations helps ensure your RV remains legally compliant. Each state has unique laws governing salvage titles, which can affect insurance coverage, registration, and resale value.

Variations In Salvage Title Laws

Salvage title laws vary significantly from state to state. Some states have strict rules, while others are more lenient. For example, in California, a salvage vehicle must pass a rigorous inspection before it can be rebranded as rebuilt. In contrast, Texas has a more straightforward process for rebranding salvage vehicles. Knowing these differences can save you time and money.

Some states also have different categories for salvage titles. These categories can include “rebuilt,” “reconstructed,” or “total loss.” Each category has its own set of requirements and implications. Understanding these categories helps you navigate the salvage title process more effectively.

How To Check State Requirements

To check state requirements for salvage titles, start by visiting your state’s Department of Motor Vehicles (DMV) website. Most DMV websites provide detailed information about salvage title regulations. You can also contact your local DMV office for specific questions.

Another option is to consult with an insurance agent familiar with salvage titles. They can provide insights into state-specific regulations and help you understand how these laws affect your insurance. Additionally, many states offer online resources and guides to help you through the salvage title process.

Acquiring A Salvage Title For Your Rv

Getting a salvage title for your RV can seem daunting. But with the right steps and documentation, it becomes simpler. This guide will help you understand the process.

Steps To Obtain A Salvage Title

- Contact your local DMV office.

- Complete the necessary application forms.

- Have your RV inspected.

- Submit the inspection report to the DMV.

- Pay the required fees.

- Receive your salvage title.

Necessary Documentation

Ensure you have all the required documents ready. Here’s a list of what you will need:

- Proof of ownership (original title or bill of sale).

- Application form for a salvage title.

- Inspection report from a certified inspector.

- Proof of repair costs, if applicable.

- Payment for fees (check or credit card).

- Identification (driver’s license or state ID).

Each state may have different requirements. It’s essential to check with your local DMV. Having the correct documentation will speed up the process.

Insuring An Rv With A Salvage Title

Insuring an RV with a salvage title can be challenging. A salvage title means the RV was damaged and declared a total loss by an insurer. Many insurers hesitate to offer coverage for these vehicles. Yet, insuring a salvage title RV is possible. The process requires patience and diligence.

Challenges In Getting Coverage

Insurers view salvage title RVs as high-risk. This is because these vehicles have a history of significant damage. As a result, many mainstream insurers may refuse coverage. Those who do offer coverage may impose higher premiums. They may also limit the types of coverage available.

Another challenge is the limited availability of comprehensive coverage. Insurers often exclude collision or comprehensive coverage for salvage title RVs. This means you may only get liability insurance. Finding the right insurer willing to cover your RV becomes crucial.

Tips For Finding The Right Insurer

- Research Extensively: Look for insurers who specialize in salvage title vehicles. These companies are more likely to offer coverage.

- Get Multiple Quotes: Contact several insurers to compare quotes. This helps you find the best deal.

- Prepare Documentation: Have all necessary paperwork ready. This includes repair records, inspection reports, and the salvage title.

- Consider Local Insurers: Smaller, local insurers may be more flexible. They might offer coverage when larger companies won’t.

- Maintain Good Credit: A good credit score can help you get better rates. Insurers often consider credit scores when determining premiums.

Finding the right insurer for a salvage title RV takes effort. But with persistence, you can secure the coverage you need.

Cost Considerations

When dealing with an RV insurance salvage title, understanding the cost considerations is crucial. These costs can vary significantly and impact your overall budget. Below, we break down the key areas you need to consider.

Impact On Insurance Premiums

Salvage titles often result in higher insurance premiums. This is because insurers see these RVs as higher risk. They have been in accidents or have significant damage. Here is a quick comparison:

| Title Type | Average Premium |

|---|---|

| Clean Title | $800/year |

| Salvage Title | $1,200/year |

As shown, premiums for salvage title RVs can be about 50% higher. Factor this into your budget to avoid surprises.

Repair And Restoration Costs

Repairing a salvage title RV can be expensive. The costs depend on the extent of the damage. Here are common repair costs:

- Engine repairs: $1,000 – $5,000

- Bodywork: $500 – $3,000

- Electrical systems: $200 – $2,000

These costs add up quickly. Get a detailed quote before purchasing a salvage title RV. Knowing the repair and restoration costs helps you make an informed decision.

Credit: www.autoinsurance.org

Resale Value Of Salvage Title Rvs

Salvage title RVs often come with lower resale values. Insurance for these RVs varies by state, affecting coverage options. Understanding the insurance rules in your state is crucial.

The resale value of salvage title RVs can be complex. Many buyers see a salvage title as a red flag. Yet, there are ways to improve your chances of a successful sale. Understanding the market value and following best practices can help you achieve a fair price.

Market Value Implications

Salvage title RVs are typically valued lower than those with clean titles. This is due to the damage history and the potential risks involved. Buyers often worry about hidden issues. They might wonder if the repairs were done properly. This creates a lower demand.

| Factor | Impact on Value |

|---|---|

| Damage History | Decreases Value |

| Repair Quality | Can Increase Value |

| Documentation | Improves Buyer Confidence |

The market value depends on these factors. Good documentation and quality repairs can help mitigate the negative impact.

Best Practices For Selling

Selling a salvage title RV requires transparency and effort. Follow these best practices:

- Provide detailed repair records.

- Be honest about the damage history.

- Get a professional inspection.

- Offer a competitive price.

Detailed repair records build trust with potential buyers. Being honest about the damage history can prevent future disputes. A professional inspection can offer an unbiased view of the RV’s condition. Offering a competitive price helps attract buyers. Here is a simple checklist:

- Gather all repair records.

- Get a professional inspection.

- Be transparent about the damage.

- Set a fair price.

By following these steps, you can increase your chances of selling your salvage title RV at a fair value. “`

Legal And Safety Concerns

Legal and safety concerns are crucial when dealing with RVs that have a salvage title. Safety inspections and legal implications vary by state. Understanding these aspects ensures that your salvage RV is roadworthy and compliant.

Roadworthiness And Safety Inspections

RVs with salvage titles must pass rigorous inspections. These inspections check if the RV is safe for the road. Inspectors look for structural damage and mechanical issues. They also check the RV’s electrical systems. These checks ensure your RV meets safety standards.

Each state has different inspection rules. Some states require a detailed report. This report must outline all repairs made to the RV. Other states may have simpler inspection requirements. Always check your state’s specific rules. This helps you avoid any legal issues later.

Legal Implications Of Driving A Salvage Title Rv

Driving a salvage title RV has legal implications. Some states have restrictions on salvage title vehicles. You may need special permits to drive these RVs. Failing to comply with these laws can lead to fines. In severe cases, you could face legal action.

Insurance for salvage title RVs can also be tricky. Many insurers are hesitant to cover these vehicles. You may find it hard to get full coverage. Some insurers offer limited policies. These policies may not cover all types of damage. Always read your insurance policy carefully.

Being aware of these legal and safety concerns is essential. It helps you stay compliant with the law. It also ensures your RV is safe to drive. Proper knowledge can save you from future headaches. Stay informed and drive safely.

Tips For Potential Buyers

Buying an RV with a salvage title can be a great way to save money. But it comes with risks. It is important to know what to look for. Ask the right questions. Here are some tips for potential buyers.

What To Look For In A Salvage Title Rv

Check the RV’s history. Find out why it has a salvage title. Look for signs of damage. Water damage, fire damage, or collision damage can be costly to repair. Inspect the RV’s frame and structure. Ensure everything is safe and sound.

Check the mechanical systems. This includes the engine, transmission, and brakes. Make sure they are in working order. Inspect the interior. Look for mold, mildew, or any signs of wear and tear. Confirm that all appliances and systems work properly.

Questions To Ask The Seller

Ask the seller why the RV has a salvage title. Get details about the damage it sustained. Ask if the RV has been repaired. If so, find out who did the repairs. Were they a certified professional? Get copies of repair receipts and any warranties.

Ask about the current condition of the RV. Are there any issues that need attention? Is the RV roadworthy? Have it inspected by a trusted mechanic. This can give you peace of mind. Get all the facts before making a decision.

Frequently Asked Questions

What Is A Salvage Title For An Rv?

A salvage title for an RV means the vehicle has been declared a total loss by an insurance company. This usually happens after significant damage. Salvage title RVs can be repaired and re-registered.

Can You Insure An Rv With A Salvage Title?

Yes, you can insure an RV with a salvage title. However, coverage options may be limited. Some insurers offer liability-only policies. Comprehensive and collision coverage might be harder to find.

Is It Worth Buying A Salvage Title Rv?

Buying a salvage title RV can be worth it if you’re looking for a bargain. Ensure the RV is thoroughly inspected. Understand the extent of the damage and repair costs before purchasing.

How Do I Register A Salvage Title Rv?

Registering a salvage title RV involves repairing the RV to meet safety standards. You must then pass a state inspection. Submit the inspection report and repair receipts to the DMV for registration.

Conclusion

Understanding RV insurance for salvage titles is essential for all states. You need to ensure coverage meets your needs. Salvage titles can be tricky, but with the right knowledge, you can navigate them. Always research and compare insurance options. This way, you secure the best deal.

Stay informed and protect your investment wisely. Your RV adventures await with peace of mind. Safe travels!